What is Tax Deducted at source?

Income – Tax is Collected/recovered at two stages, namely pre-assessment stage and post assessment stage. The method by which pre-assessment tax are collected is in the following manner at different stages namely,

- Advance Tax.

- Tax Deducted at source.

- Tax Collected at Source.

Objectives of introduction of Tax Deducted at Source.

- It helps in reporting the correct Incomes.

- It helps in checking Tax evasion.

- Early collection of revenue by the Government.

- It is the cheapest mode of collection of tax.

- It helps to widen the tax base as more and more people are covered.

TDS Implication Undersection 194C

- Deduction of tax at source (TDS) from payment to resident contractors.

- Deduction of TDS from payment to resident sub-contractors

Payer in (Contractee) Section 194C

- The central government and state government or;

- Any local authority or;

- Any statutory corporations or;

- Any company or;

- Any co-operative society or;

- Any statutory authority dealing with housing accommodation or for the purpose of planning, development or improvement of cities, towns and villages or for both or;

- Any society registered under the Societies Registration Act, 1860 or;

- Any trust

- Any university established or incorporated by or other a central, state or provincial act and an institution declared to be university under the UGC act,1956 or;

- Any firm or;

- Any government of a foreign state or foreign enterprise or any association or body established outside India or;

- Any person, being an individual, HUF, AOP or BOI, who has total sales or gross receipts or turnover from the business or profession carried on by him exceeding 1 crore in case business and 50 lakhs in case of profession during the financial year immediately preceding the financial year in which such sum is credited or paid to the amount of the contractor.

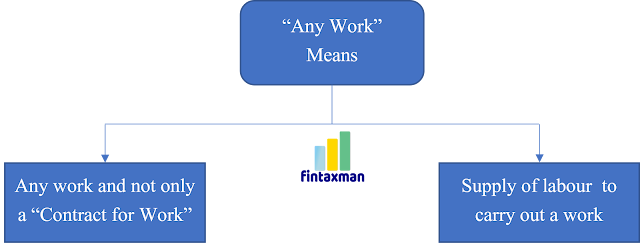

Definition of Work in TDS in Contractor

- Advertising

- Broadcasting and telecasting including production of Programmes for such broadcasting or telecasting

- Carriage of goods or passengers by any mode of transport other than by railways

- Catering

- Manufacturing or supplying a product according to the requirement or specification of a customer by using material purchased from such customer or its associate, being a person related to the customer. In such a case, tax shall be deducted on the invoice value excluding the value of material purchased from such customer or its associate, if such value is mentioned separately in the invoice. Where the material component has not been separately mentioned in the invoice, tax shall be deducted on the whole of the invoice value.

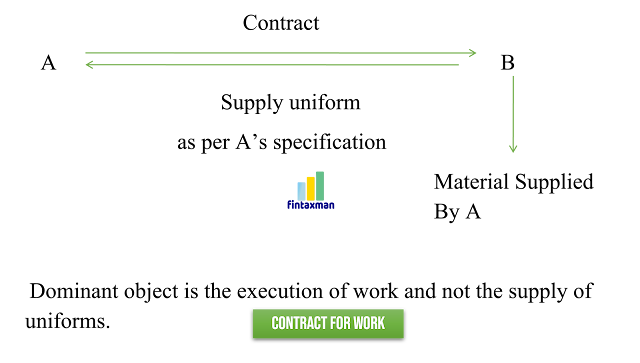

Contract for Work Vs Contract for Sale

|

| Contract for Sale |

|

| Contract for work |

|

Contract for Work |

Contract for Sale |

|

Principal

object of the contract is one of work and labour even through some material

might have been used in execution of the contract |

Main

object is the transfer of property and the delivery of the possession of a movable

property even though goods might have been manufactured as per the requirement

and specification of the client |

|

Article

is brought into existence by applying work and labour and materials are

consumed in execution of the work |

Article

has an identifiable existence prior to its delivery to the purchaser and when

the title to the property vests with the purchaser only upon delivery |

TDS to Sub-Contractor

- As per the provisions of income tax act, any person (being contractor and not being an individual or Hindu undivided family),

- Responsible for paying any sum to any resident

- In the fulfilment of a contract with the sub-contractor or for the supply of labour for carrying out the whole part of the work taken by the contractor or for supplying whether wholly or partly any labour which the contractor has taken to supply shall,

- Time of credit of the amount in the account of the sub-contractor

- Time of payment in cash

- By issue if a cheque or draft or by any other mode, whichever is earlier

- Deduct an amount equal to 1% of the sum as income tax or income comprised therein.

Condition for payment to Sub-contractor

- Payment is made to a sub-contractor who is resident within the meaning of section 6 of the income tax act, 1961

- Payment is only done by the contractor

- Payment is made to carry out any work, including the supply of labour

- The amount of consideration of the contract in respect to which payment is made should not be less than Rs. 30,000

- The amount should be credited or paid by the contractor itself of a contract undertaken by him with the specified bodies

TDS on Contract is deducted under Section 194C

- At the time of crediting such amount to the payee account

- At the time of payment in cash or by issuing a cheques or by any other means, whichever is faster mode of payment

- The tax has to be deducted even if the amount payable to resident contractor or subcontractor is transferred to suspense account by the payer in his books.

Rate of TDS on Section 194C

|

Serial No |

Nature of Payment |

TDS rate if PAN available |

TDS Rate if PAN not available |

|

1 |

Payment or

Credit to resident individual or HUF |

1% |

20% |

|

2 |

Payment or

Credit to any resident person other than individual or HUF |

2% |

20% |

|

3 |

Payment or

Credit to transporters |

NIL |

20% |

- For 1 single Contract – 30,000/-

- For aggregate in a year – 1,00,000/-

- No TDS by an Individual or an HUF -- personal purposes

- No TDS-- for sum credited/paid to a contractor during the course of business of plying/hiring/leasing of good/carriages on furnishing Pan to the payer/ deductor.

Non-applicability of TDS for Transporter

- Owns ten or less goods carriages at any time during the Financial Year.

- Is engaged in the business of plying, hiring or leasing goods carriages

- Has furnished a declaration to this effect along with his PAN.

- Any motor vehicle constructed or adapted for use solely for the carriage of goods or

- Any motor vehicle not so constructed or adapted, when used for the carriage of goods.

Minimum amount of payment for deduction of TDS

|

Case

1 |

Single

contract of Rs. 30,000 |

No |

|

Case

2 |

Two

contracts of Rs. 30,000 each in the year |

No |

|

Case

3 |

Three

contracts of Rs 40,000 each in the year |

Yes

(TDS to deducted on Rs. 1,20,000) |

|

Case

4 |

Single

contract of Rs. 40,000 each in the year |

Yes |

|

Case

5 |

Five

contracts of Rs. 15,000 each in the year |

No |

|

Case

6 |

Seven

contracts of Rs. 15,000 each in the year |

Yes

(TDS to deducted on Rs. 1,05,000) |

Time limit within TDS on Contract is to Deposited

- Payment is made on behalf of the Government – On the same day

- Payment is made other than the Government

- If the amount is credited in the month of march – On or before April 30th

- In another month – within 7 days from the end of the month in which the deduction is made

Issue of TDS on Contract Certificate

|

Quarter |

Due date for non-Government deductor |

Due date for Government deductor |

|

April

to June |

30th

July |

15th

August |

|

July

to September |

30th

October |

15th

November |

|

October

to December |

30th

January |

15th

February |

|

January

to March |

30th

May |

30th

May |

TDS at a Lower Rate

TDS Return of 194C

- 31st July for Q1,

- 31st October for Q2,

- 31st January for Q3, and

- 31st May for last quarter.

Code USED in RPU

- 94C for Section 194C

- · 01 for company

- · 02 for Non company

Reason for lower /Higher / NIL deduction

|

Code |

Category |

|

A |

Lowe / Nil

deduction certificate u/s 197 |

|

C |

“PANAPPLIED”,

“PANVALID” or “PANNOTAVBL” Higher TDS rate for no PAN |

|

T |

In case of

Transporter transaction and valid PAN is provided |

|

Y |

Within

threshold limit – hence no TDS |

|

Z |

Notified

organization u/s 197A (1F) |

Conclusion

FAQ's

Is GST included while calculating TDS under 194C?

No, if GST is shown separately on the invoice, TDS is deducted on the amount excluding GST

Is TDS applicable on advance payments to contractors?

Yes, TDS applies even on advance payments.

Is TDS deducted if the contractor is a non-resident?

No, Section 194C applies only to resident contractors. For non-residents, Section 195 applies.

What if multiple small payments under ₹30,000 are made, but the total exceeds ₹1,00,000 in a year?

TDS must be deducted once the aggregate exceeds ₹1,00,000.

Are reimbursement of expenses included in TDS calculation?

Yes, unless supported by actual bills or treated separately in the contract.